Early Days

Understanding the Needs of Investors

Reasons for funding

Experimentation

What Keeps You Going

This is Your Sign to Start

As the founder of Rehook, I’d like to pass on a few pieces of funding and business knowledge that I have obtained over the years. It is a lot of peoples dream to start their own business and work on their own terms. We have been fortunate to have a community that has been incredibly supportive of our brand, so I’d like to return the favour! Some tips below...

- Wayne

Early Days

My background is in software. I have been part of the founding team at various startup companies as a CTO and Product Officer; starting from zero with no products or team, finding product market fit and scaling.

With funding I have been part of entirely bootstrapped companies, crowdfunding campaigns, seed funding, bridging rounds and most recently an angel investment on Dragons Den.

A few years ago I set up Rehook as a bit of a hobby. I felt I had learned all I could about how to run a business through work and felt the next area to learn was setting one up. I was doing this to challenge myself in new aspects of business, so I knew I had to stay away from making software. (Software also needs constant development and has a shelf life, so I knew I needed to work on a physical product that I could park for several months and it wouldn’t lose its value.)

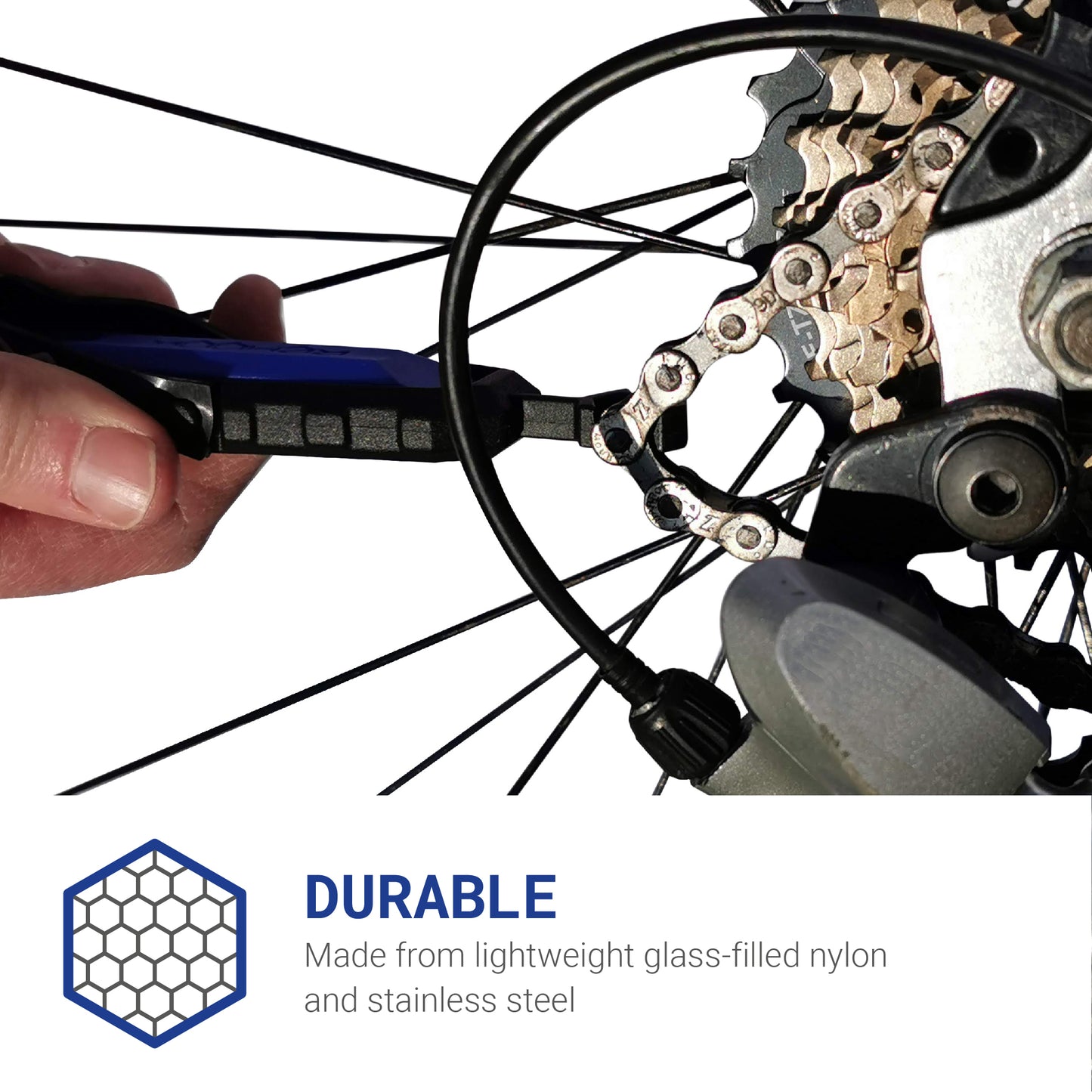

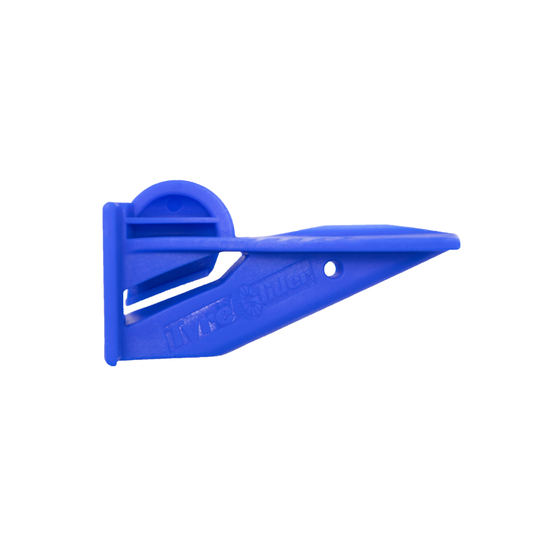

I had a bunch of ideas but decided to go for developing a tool to get your chain back on your bike. Mostly because it was something new, with no competition for it, but also because I knew the development and manufacturing would be reasonably straight forward. When you’re first starting to develop your own business, it’s best to stick to what you’re good at and what keeps you motivated. One of the main key to success is the ability to keep pushing the company everyday so your own motivation and endurance is really important.

Understanding the Needs of Investors

I took our original product to Dragon’s Den in 2019 and was fortunate enough to have offers from all 5 of the Dragons. We went ahead with an investment from Deborah Meaden for 25% share of the company.

I would put the success of our pitch down to 2 things: the numbers and our story.

-

You need to be constantly building up the story of a company and thinking about what you need next to continue that story.

-

Investors care about NUMBERS so you need to tell them your story with numbers and tell them your numbers through your story.

You need to understand your investors and where they are at. In my experience:

-

Dragons are similar but get a lot of the work like due dil done for them upfront so will invest in a wider range of areas outside of their industry. But the upfront due dil means that they can see more pitches so are in a position to expect a better rate for an investment. They are also on show too, so there is more expectation to put you on the spot.

-

A group like a Local Enterprise Partnership needs to reach a wider agreement, so are a good option for an established technology, but in my experience they can be less likely to look at anything higher risk. They often offer match-funding so can be a good option to mix with other forms of investment.

-

Crowd funders are usually looking for something ‘cool’ so it's much easier to get funding for consumer products or something that captures the imagination.

It's also really important to understand the different rounds of investment and what their purposes are. If you are raising seed funding then you need a tight focus on reaching a solid product market fit before the cash runs out. If you need to start raising multiple seed rounds then it's going to start affecting your story. You need to stay disciplined with why you're doing an investment round and have realistic expectations of how it's going to get you to stability or the next stage. Focus is key.

Reasons for funding

If you're out pitching all day (which is a full time job in itself) then you're not developing the business and exploiting other opportunities. So choosing the right time and the right reasons for seeking investment is vital.

In software, people talk a lot about technical debt, but I also see most business decisions in operational debt. Investment is no different. Every action that a business takes requires some level of maintenance, whether it's a clearly defined process or just something that someone in your team does as part of their everyday work and can be forgotten (missed, not handed over when they are ill or if they leave the business). Over time, this debt can make businesses less able to adapt and less likely to make changes.

When a business is new, it’s focus can be tweaked as new opportunities arise and more knowledge is gained. As a company becomes more established and has more operational debt, expectations (from customers etc.) then it becomes more difficult to make changes.

Having investors adds to operational debt. It may only be a little if you have 1 investor but if you add multiple investors and (maybe) crowd funding rounds, then it could become more complex to change direction, make the most of new opportunities or keep focus.

I have found having an investor has helped me to be more thorough with accountancy. The additional accountability has meant that I investigate any discrepancies more than I would otherwise do. At the same time I sometimes feel bound to the existing business plan rather than being able to explore bigger opportunities that arise outside of cycling. This is better for focus and company growth - but can at times feel a little like working for someone else.

It is therefore really important that you have a really clear equation of ‘this much investment will buy me this much growth’. I think too many companies seem to spend their time chasing revenue and not trying to become financially sustainable so focus is key.

Experimentation

Try to always be in a position to take on new opportunities. You usually only get 1 or 2 really big new ideas each year, so you need to be ready to act on them when they come along. The best way I have found to do this is through reducing operational debt. In practice, these are lightweight processes (which is good practice not best practice), continuous improvement, automating whatever you can and by stopping doing things that are not adding value.

What Keeps You Going

With every successful business person I have worked with they all seem to have one thing in common and that is the ability to keep pushing. Sometimes this is from naivety, to learn, to prove themselves, pure arrogance, blind faith or anything else. It doesn't matter the reason why, just that they are able to keep going no matter what.

For me it's probably a mix of some of these things but I’ve also tried to set the business up in a way that makes this easier.

-

I still try to keep it in a position where I can take a break if I need to - though not always successfully.

-

I also keep track of all tasks in a management system like Asana or Height so that I can look back and see how much I have achieved on days where it feels like I haven’t made much progress.

This is Your Sign to Start

In summary raising investment is loads of work! Successful crowdfunding is a colossal marketing exercise and raising investment is a massive sales role. So its vital you have a clear case for why you are doing it and have realistic expectations for both your investment of time and your expected outcomes.

For those who are thinking about starting a new venture then the best thing to do is to just get going. Find something you enjoy doing and can do well. Lots of people worry about having the right idea, but in reality, it’s the right execution that is the most important. I strongly believe that there is an angle to execute any idea well, regardless of how ‘good’ it is.

I am not an investment expert, so this is just based on my own experiences but I hope that you have taken away some knowledge that will be of value. Chat with us on our social media profiles and in the comments below and let us know if you enjoy this type of content!

Thank you for reading,

- Wayne